TCS which refers to the Tax collection at source. The seller must collect the tax from the buyer to remit to the government. Indian Government has introduced TCS on sale of the products with effect from 1st October 2020.

Applicability:

- for the sellers, whose turnover exceeds 10 crores.

- applicable on all goods sold. Its not applicable on services which attract TDS.

- On Sales to the buyers who have bought more than 50 Lakhs in the financial year.

Amount of Tax

- .075 % of the sales value more than 50 Lakhs. 1% if the PAN is not submitted by the buyer.

Time of Payment

The Tax is payable only when the seller receives the Money. Unlike GST, its not due at the time of raising the invoice.

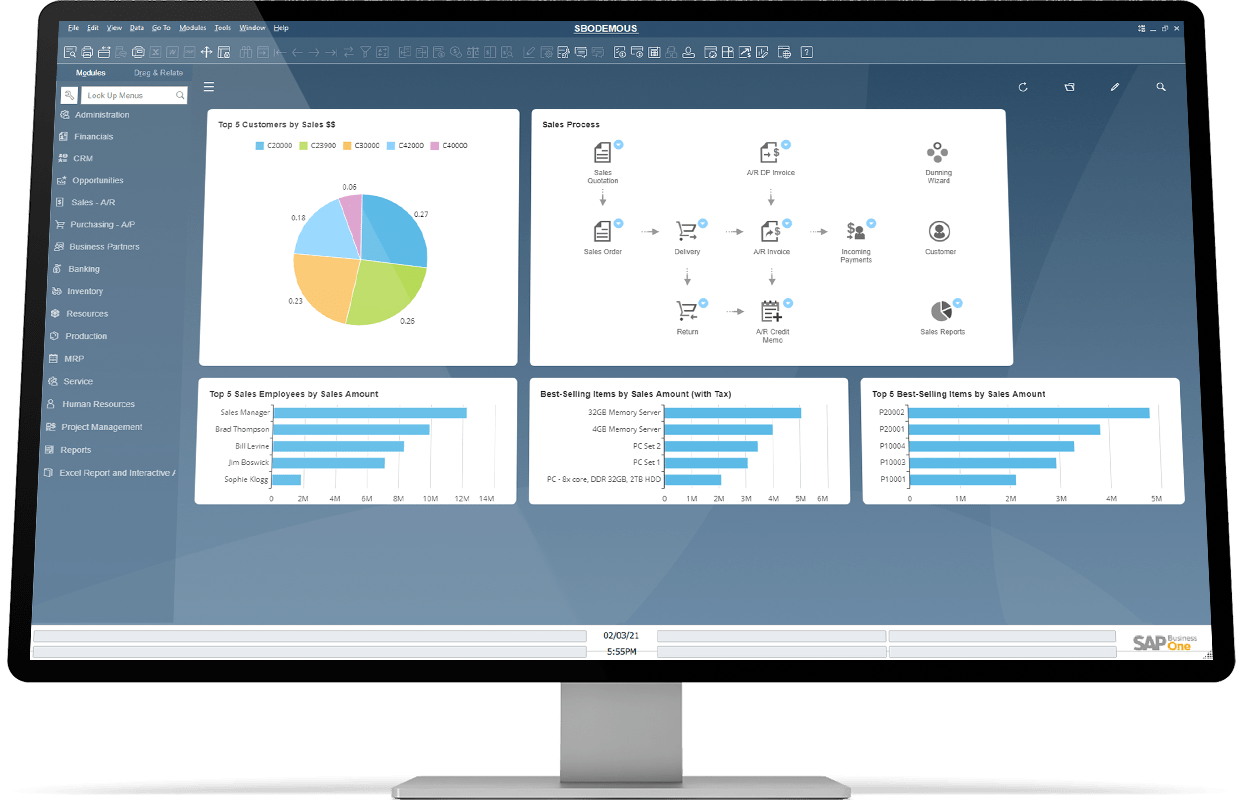

Challenges in SAP Business one.

The taxes are levied on the invoice which is accounted as liability at the time of invoicing. However, the actual liability arises only when we receive the payment. We need to build a report on the incoming payment to calculate the actual liability and manually post the journal entries.

SAP India is working on the solution, which will be released in the next patch level which is expected in November 2020.